The worldwide monetary companies market is remodeling, pushed by the meteoric adoption of digital wallets. What started as a handy method to retailer cost playing cards on smartphones has advanced into an ecosystem reshaping how billions of individuals handle cash.

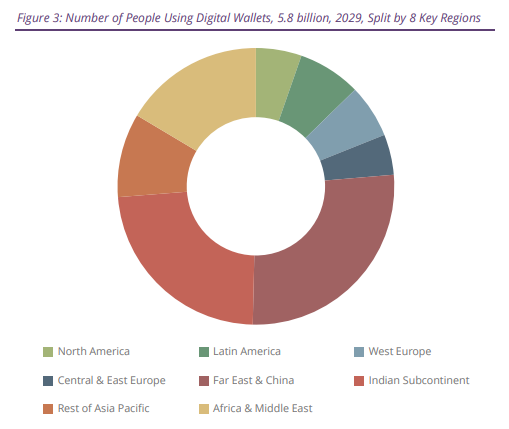

In line with Juniper Analysis’s newest worldwide market examine, digital pockets adoption is about to rise once more, with consumer numbers projected to surge from 4.3 billion in 2024 to five.8 billion by 2029.

This development trajectory is about elementary adjustments in how we entry monetary companies. Probably the most compelling Fintech transformation is occurring in creating markets, the place ‘Cellular Cash’ options are bypassing conventional banking infrastructure solely.

Digital Pockets Market Growth

In areas with massive unbanked populations, digital wallets have develop into the primary level of entry into the formal monetary system, permitting individuals to retailer, spend, and switch cash without having a conventional checking account.

The market has advanced to help three distinct fashions: closed-loop methods for particular retailers, semi-closed networks for outlined consumer teams, and open-loop methods that work throughout a number of retailers and platforms.

Every serves totally different wants and market segments, contributing to the expertise’s widespread adoption.

The combination of Open Banking capabilities is a game-changer, permitting pockets suppliers to provoke funds immediately from customers’ financial institution accounts whereas by no means really storing delicate monetary data. This not solely enhances safety but in addition reduces friction within the cost course of – a vital think about consumer adoption.

Maybe essentially the most intriguing improvement is the rise of “superapps” – notably in Southeast Asia and China. These platforms have remodeled digital wallets from easy cost instruments into complete life-style functions.

Corporations like WeChat and Gojek have proven that by combining funds with social networking, e-commerce, transport, and different companies, digital wallets can develop into the centerpiece of customers’ day by day digital interactions.

This mannequin has confirmed so profitable that many Western corporations in mature banking markets at the moment are exploring comparable approaches, albeit with various levels of success.

A number of key traits will doubtless form digital pockets market improvement.

First, the competitors for consumer loyalty will intensify, with suppliers more and more specializing in personalised rewards and incentives. The leaders within the house – together with Huawei, Ericsson, and Comviva – are already differentiating themselves by providing superior capabilities like micro-loans and revolutionary credit score merchandise in rising markets.

QR code expertise, regardless of being practically three many years outdated, is experiencing a renaissance within the digital funds house. Its versatility in facilitating each service provider funds and peer-to-peer transfers, mixed with its low implementation price, makes it notably precious in markets the place conventional cost infrastructure may be missing.

In developed markets, the place banking infrastructure is mature, digital pockets suppliers might want to give attention to value-added companies and higher integration with present monetary methods.

In rising markets, the chance lies in monetary inclusion – offering fundamental monetary companies to populations which were traditionally underserved by conventional banks.

Outlook for Digital Pockets Development Alternatives

“These fundamental monetary companies enable pockets suppliers to diversify income streams. These suppliers should reap the benefits of cellular monetary service licenses, the place obtainable, as they’re usually related to a decrease regulatory burden than full banking licenses,” stated Michael Greenwood, senior analysis analyst at Juniper Analysis.

Wanting forward, I consider digital pockets capabilities will develop quickly. The combination of synthetic intelligence (AI), blockchain expertise, and enhanced biometric safety may open up new use instances.

For buyers on this house, the message is obvious: the digital pockets market represents a big development alternative, however success would require extra than simply technical functionality.

Understanding native market dynamics, regulatory necessities, and consumer wants will probably be essential. Those that can mix these parts whereas delivering an built-in, safe, and precious service will probably be well-positioned to seize a share of this quickly increasing market.